BRAZIL - 2020/07/04: In this photo illustration the Verisign logo seen displayed on a smartphone. ... [+]

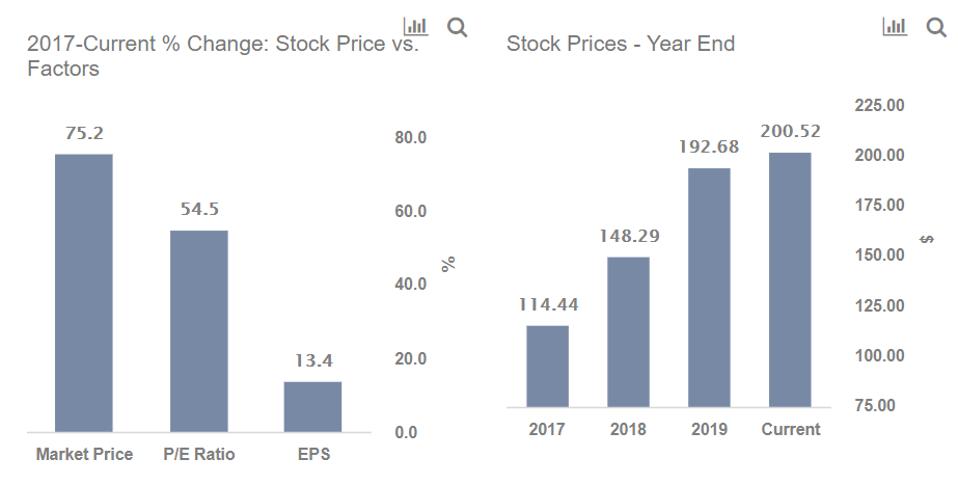

SOPA Images/LightRocket via Getty ImagesDespite a more than 30% rise from its low in March, at the current price of $200 per share, we believe Verisign stock (NASDAQ: VRSN) is still a good opportunity for investors. Verisign stock has risen from $151 to $200 off the recent bottom, less than the S&P which increased by more than 60% from its recent lows. However, the stock is up just 4% from the level it was at the start of the year, and is far from its 2020-high of $220. We believe that Verisign’s stock could soar to fresh highs, rising around 15% from its current level, driven by expectations of rising demand and strong Q3 2020 results. Our dashboard Buy Or Sell Verisign Stock? has the underlying numbers behind our thinking.

The stock price rise since 2017 end was helped by a 6% rise in revenue, which translated into a 34% jump in net income, as operating expenses as a % of revenue dropped. Verisign’s cost-cutting initiatives saw operating margins rise from 60.7% in 2017 to 65.4% in 2019. On a per share basis, earnings rose from $4.56 in 2017 to $5.17 in 2019.

Verisign’s P/E multiple rose from 25x at the end of 2017 to 37x by the end of 2019, mainly due to Verisign’s high margins and steady margin growth which led to a growth in investor expectations. The P/E multiple has further risen to 39x so far this year. We believe that the company’s P/E ratio has the potential to see a further increase in the near term on expectations of continuing demand growth and favorable shareholder return policy, thus driving the stock price higher.

Where Is The Stock Headed?

The global spread of coronavirus and the resulting lockdowns in early 2020 led to a surge in online activity, with both businesses and individuals spending more time online. Verisign’s revenues come from web domain sales and subscriptions and the past six months have seen a jump in online blog and business registrations. This is evident from Verisign’s strong Q3 earnings, with revenue at $318 million vs $308 million for the same period in 2019, a 3% jump. With no change in operating margins, a lower effective tax rate (7.5% in Q3 2020 vs 20.5% in Q3 2019) helped drive up EPS from $1.30 to $1.49. Further, even with lockdowns being lifted, working from home will gradually become the new norm, and this will help further drive demand for web domain names, as more and more people shift their businesses online.

MORE FOR YOU

These factors will raise investor expectations further, driving up the company’s P/E multiple. We believe that Verisign’s stock can rise a further 15% from current levels, to set fresh highs over $230.

Trefis

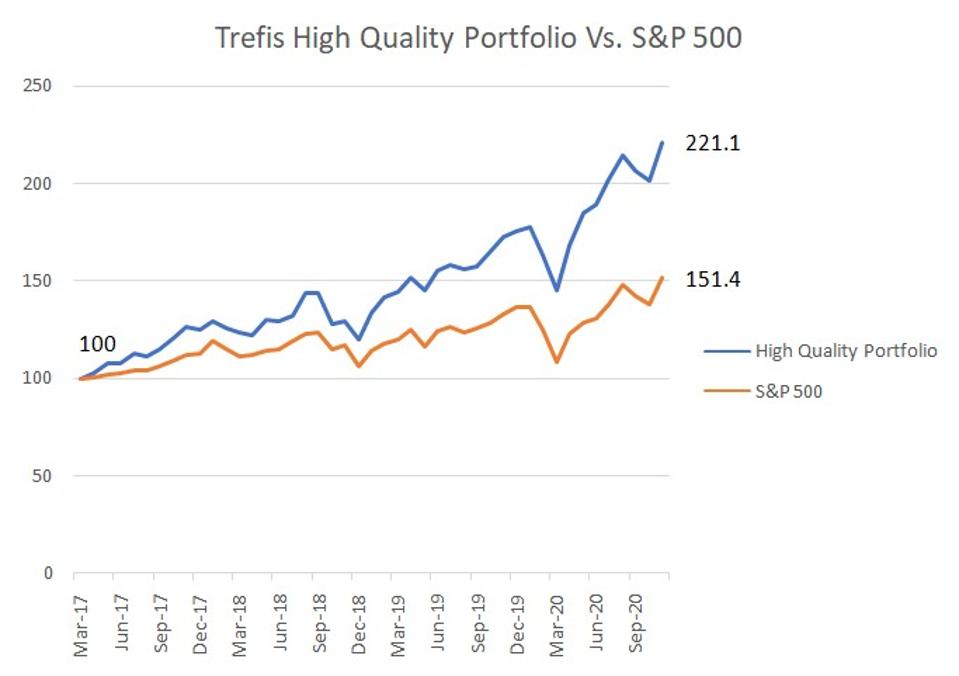

What if you’re looking for a more balanced portfolio instead? Here’s a high quality portfolio to beat the market, with over 100% return since 2016, versus 55% for the S&P 500. Comprised of companies with strong revenue growth, healthy profits, lots of cash, and low risk, it has outperformed the broader market year after year, consistently.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams

The Link LonkDecember 02, 2020 at 07:00PM

https://www.forbes.com/sites/greatspeculations/2020/12/02/verisign-stock-to-surge-to-fresh-highs/

Verisign Stock To Surge To Fresh Highs? - Forbes

https://news.google.com/search?q=fresh&hl=en-US&gl=US&ceid=US:en

No comments:

Post a Comment